Your Swiss company domicile – managed by experienced fiduciary professionals

Our registered addresses

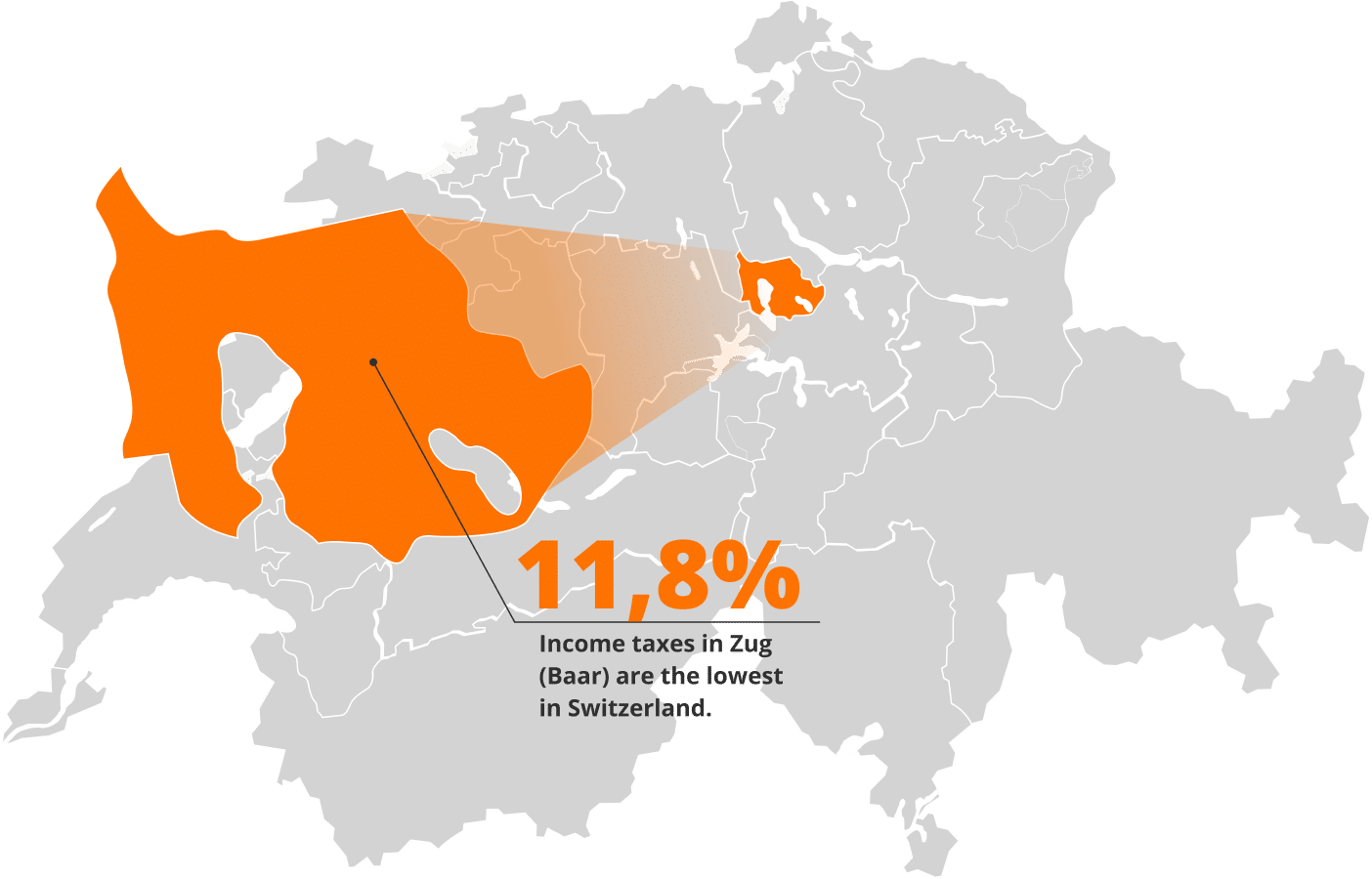

Company domicile in the cantons of Zug

Company address in modern offices, Baar (Zug)

| c/o service | Dedicated business address |

| CHF 95 / Month | CHF 150 / Month |

Company domicile in the cantons of Zurich

Company address in prime business district, Zurich

| c/o service |

| CHF 95 / Month |

- Prices apply to the domiciliation service only. Additional services can be added at any time.

- Exact address details provided upon request to ensure confidentiality.

Our services

Our fiduciary services

Calculate your bookkeeping costs in the canton of Zug

To the price calculator

Zug (Baar) compared to other cities

The calculation takes into account income tax and capital tax.

Calculation basis:

- Pre-tax profit: CHF 100,000

- Taxable capital (end of year, including profit): CHF 250,000

Zug (ZG)

Corporate taxes

CHF 11'830

11,83%

Zurich (ZH)

Corporate taxes

CHF 19'906 (↑ 8'076)

19,91% (↑ 8,08)

Bern (BE)

Corporate taxes

CHF 17'642 (↑ 5'812)

17,64% (↑ 5,81)

Chur (GB)

Corporate taxes

CHF 15'675 (↑ 3'845)

15,68% (↑ 3,85)

Solothurn (SO)

Corporate taxes

CHF 15'288 (↑ 3'458)

15,29% (↑ 3,46)

Liestal (BL)

Corporate taxes

CHF 13'864 (↑ 2'034)

13,86% (↑ 2,03)

Basel (BS)

Corporate taxes

CHF 13'242 (↑ 1'412)

13,24% (↑ 1,41)

Luzern (LZ)

Corporate taxes

CHF 12'089 (↑ 259)

12,09% (↑ 0,26)

Schaffhausen (SH)

Corporate taxes

CHF 12'027 (↑ 197)

12,03% (↑ 0,20)

FAQ – domiciliation at abrechnungen.ch

What is a domiciliation address?

It’s the official registered address of your company in the Swiss Commercial Register, hosted by a third‑party fiduciary.

Is domiciliation legally permitted?

Yes. Under Swiss law, companies may register their address with a fiduciary, provided it’s properly recorded in the Commercial Register.

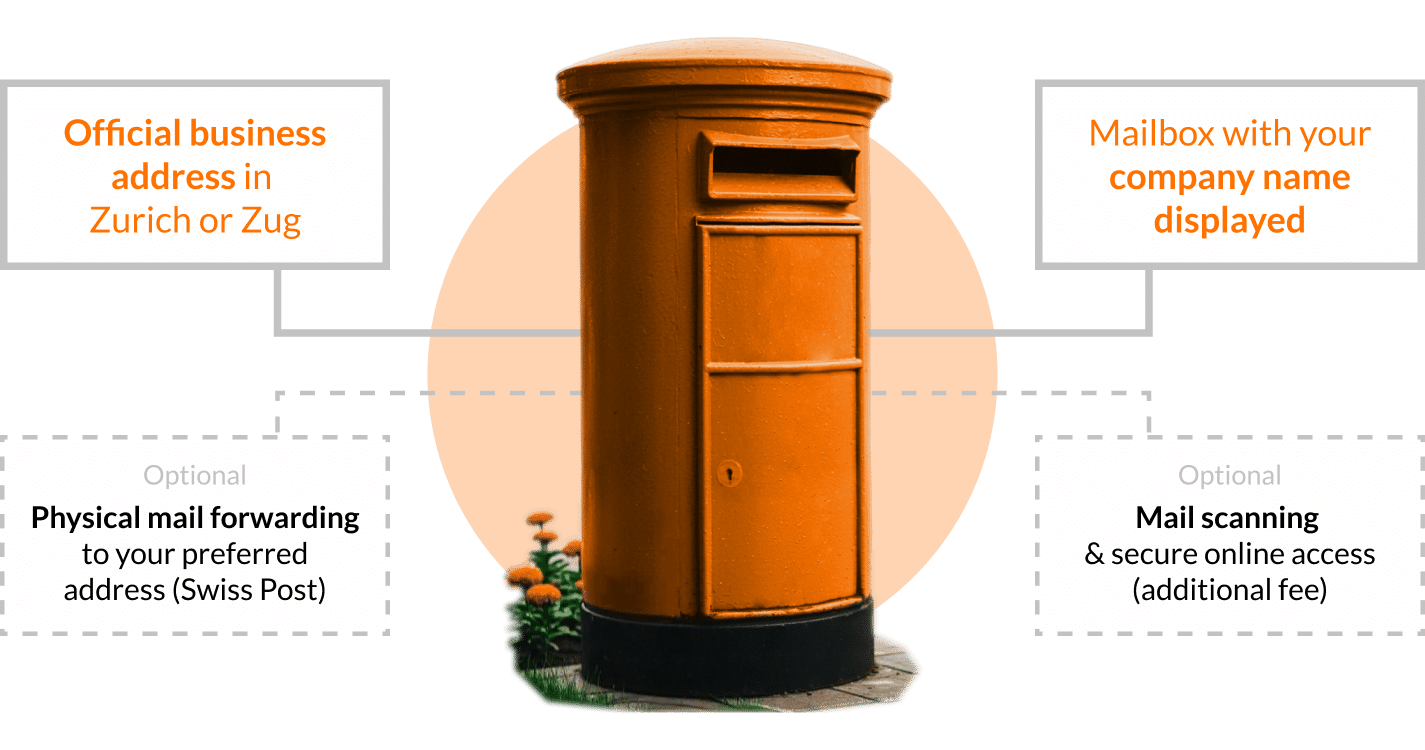

Which domiciliation services offers abrechnungen.ch?

- Business address (c/o or dedicated)

- Mail reception with optional scanning

- Support with Commercial Register entries

- Mail forwarding and authority correspondence

What advantages offers a domicile at abrechnungen.ch?

- Transparent, market‑competitive pricing

- Addresses in attractive cantons such as Zug and Zurich

- Long-standing experience of abrechnungen.ch in the field of fiduciary services

- The most affordable prices for fiduciary services in Switzerland

Can I use c/o in the Commercial Register?

Yes. c/o is allowed if mail delivery is guaranteed and a service contract exists.

Do I need a physical office if I use a domiciliation address?

No. A domiciliation address suffices for most business needs. We’ll advise if authorities or banks require additional arrangements.

Can I register my company in the canton of Zug or Zurich even if I don't live there?

Yes. Your management residence and domiciliation canton do not need to match. We’ll guide you to the right solution.

What are the benefits of a Zug or Zurich domicile?

- Low corporate taxes (especially Zug/Baar)

- Prestigious business location for international partners

How is mail forwarded?

We offer two delivery options for your mail:

- Physical mail forwarding to your preferred address

- Scanned mail available online via secure portal

How much does domiciliation cost?

Our domiciliation service starts at CHF 95/month. You can add mail forwarding, scanning, tax consulting, and other services as needed.

Rely on our specialists

Complete the contact form and our team will reach out personally.

Secure your Swiss business address today!