Do you know exactly how to prepare and file your tax declaration in Switzerland without stumbling into numerous legal pitfalls? If so, you’re a rare exception. Late submission, incorrect valuation of assets, claiming invalid tax deductions, and omitting income sources are so common mistakes that often turn tax season into a real nightmare for many. Based on our experience, such errors often result not only in additional time and stress but also in extra financial burdens — including fees, interest on unpaid taxes, legal investigations, and other potential penalties.

Over the years, we have gained extensive experience in the preparation of tax declarations and know exactly how and where tax authorities focus their attention. To make life a little easier for those concerned, we will thoroughly describe the whole process of preparation and payment of tax declarations within the Swiss tax system. Numerous tips and practical life hacks are intended to equip you with the knowledge needed to avoid possible trouble when preparing your tax declaration.

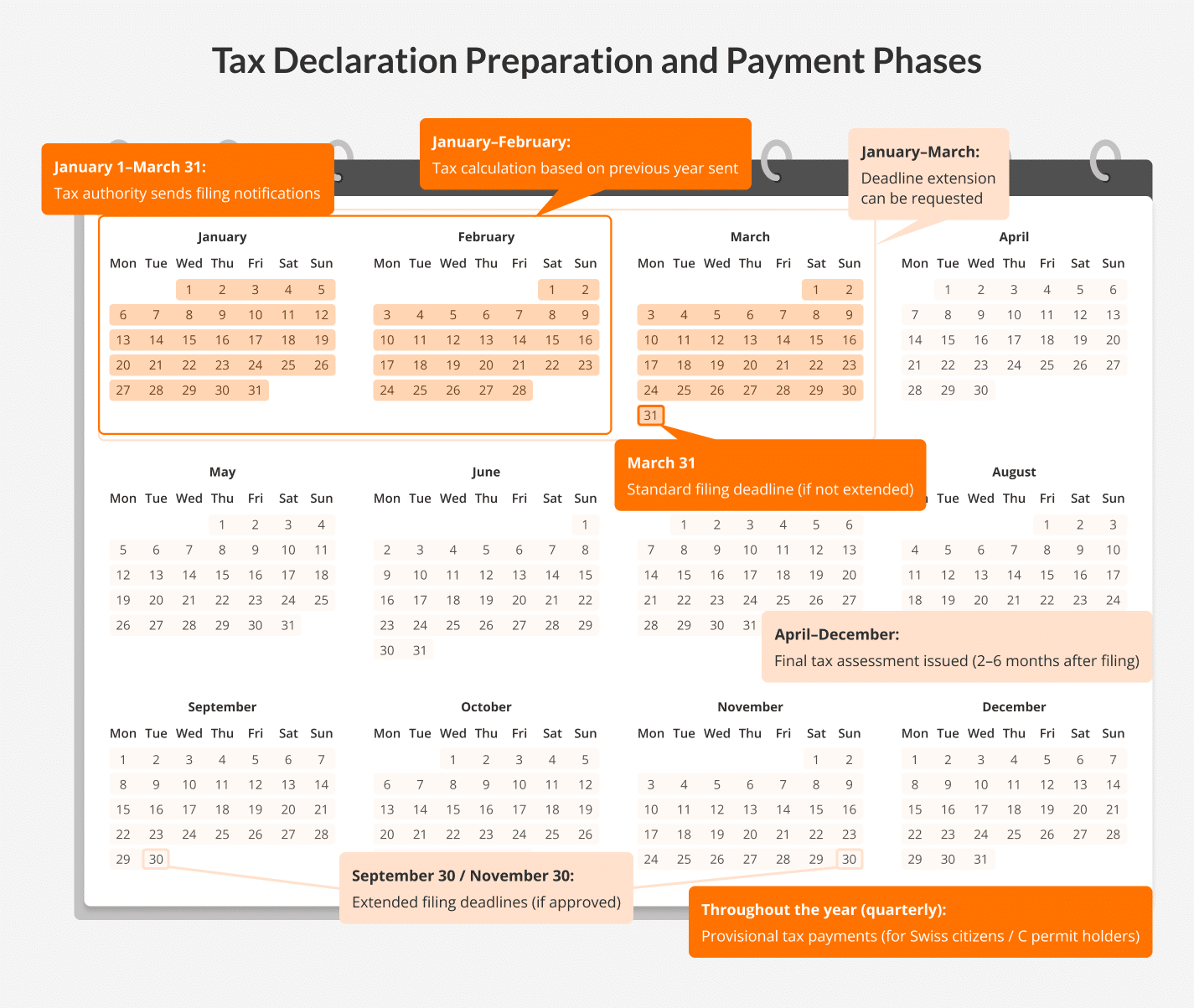

Tax declaration preparation and payment phases

Basically, there are two distinct processes involved in the tax declaration for each private individual who is required to submit one: preparation and payment. Each of these processes involves several specific steps:

Phases of the tax preparation process

- Notification from the tax authority

- Collection of financial documents

- Filling out your tax declaration

- Submission of the tax declaration to the tax authority

- Receiving the final tax invoice from your tax authority

Phases of paying your taxes in Switzerland

- Advance payments based on provisional tax invoices, issued during the calendar year using your most recent income data

- Calculation of your final tax amount based on your prepared and submitted tax declaration

- Final payment or reimbursement based on the final tax invoice from your tax authority

In practice, these processes are tightly interconnected and usually follow a certain timeline.

Each of the steps has some tricky features that are worth addressing.

Notifications from the tax authorities

In general, individuals receive notifications from tax authorities in January to submit the previous year’s tax declaration. However, in some cases, the notification may not arrive or may be delayed. Nevertheless, according to the Swiss tax system, individuals are still responsible for filing the needed documents and paying their taxes on time. This principle applies also to expats who pay withholding tax.

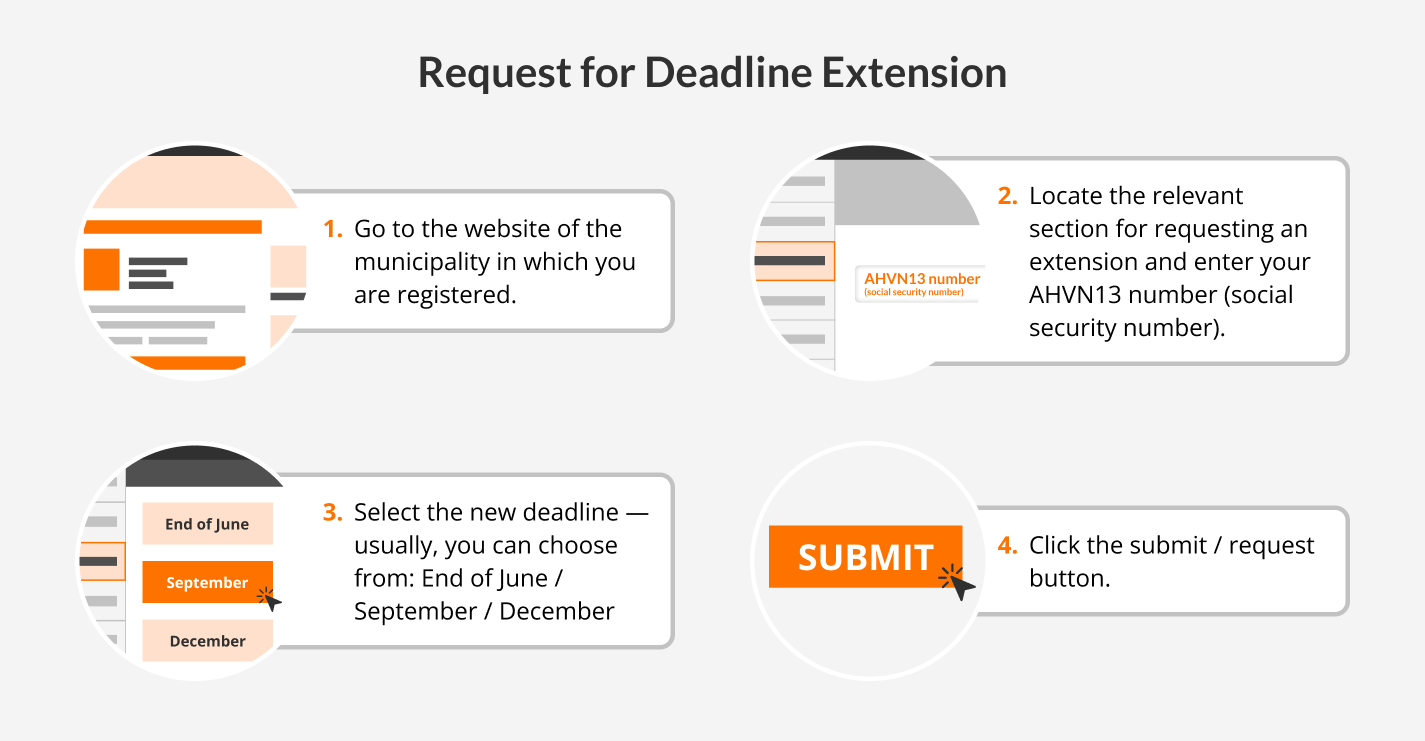

Request for deadline extension

Typically, all private individuals must submit their tax declaration by March 31 each year. However, not everyone knows that this deadline can be extended by 3 or even 6 months with minimal effort.

In case of any difficulties, it is better to approach a professional tax advisor.

Collection of financial documents

To make the preparation of your tax declaration possible, several key documents are usually required:

- Wage statement

- Bank statement showing interest and capital

- Health insurance certificate etc.

Expert tip

The list of documents needed to prepare your tax declaration may vary depending on your individual situation. That’s why it is highly beneficial at this stage to consult a professional tax preparer, who can offer valuable advice and potentially save you a great deal of time and stress.

Receiving an invoice for provisional tax amount

Swiss citizens and C permit holders are often required to pay their taxes in a lump sum. Nevertheless, many cantons offer an alternative option – payment in instalments (typically quarterly). If this option is agreed upon with the tax authority, the taxpayer will receive a provisional tax calculation, usually shortly after the tax notification in January. This provisional assessment is based on the taxpayer’s income and assets from the previous year. The system is designed to spread the tax burden evenly throughout the year.

Expert tip

Paying on time is crucial to avoid penalties. Otherwise, you may be charged interest on underpaid taxes.

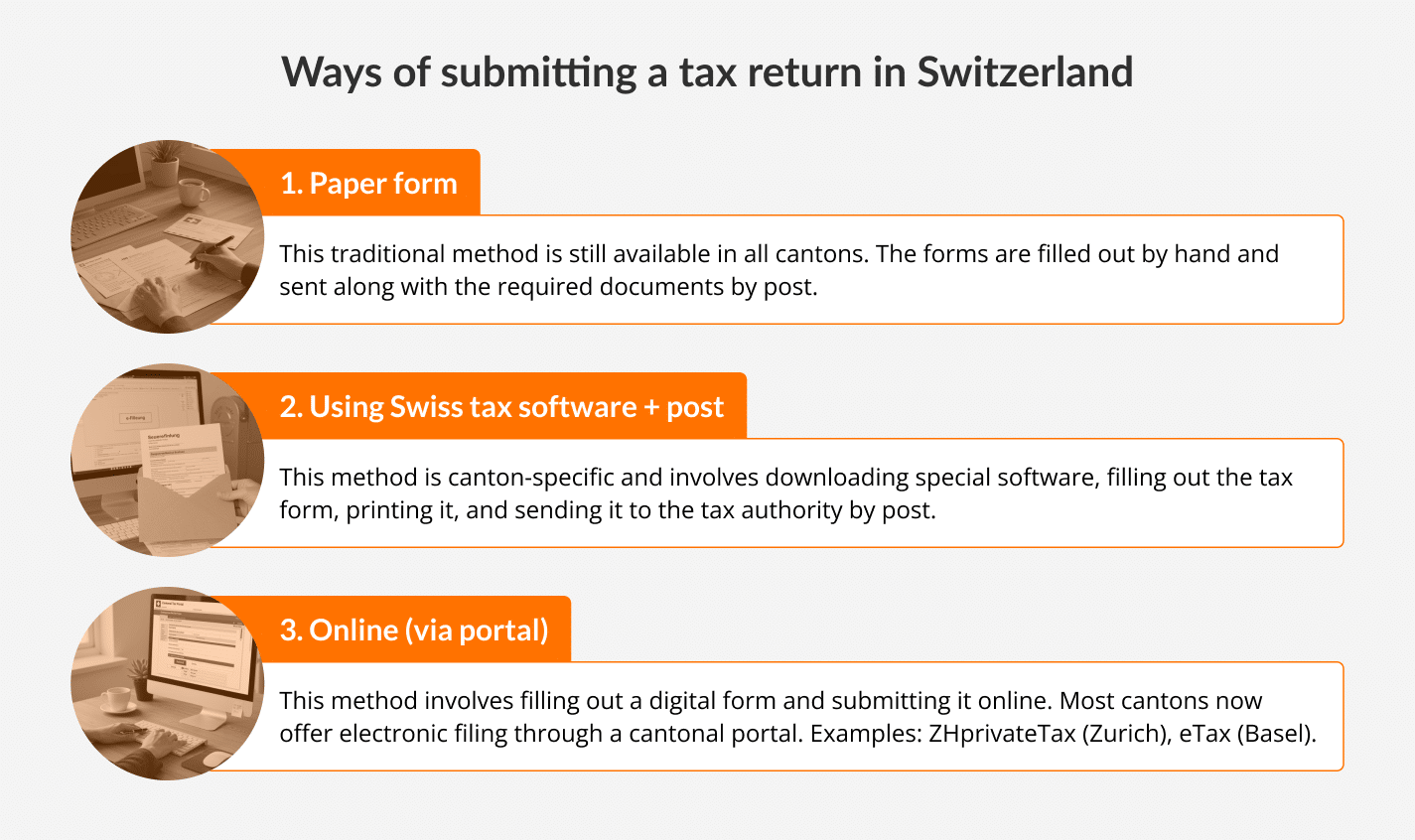

Filling out & filing your tax declaration

Filling out and filing a tax declaration in Switzerland can be done in three ways:

Although all three methods are still accepted by cantonal tax authorities, online filing is becoming increasingly popular. Some cantons (e.g., Basel) have even completely discontinued the use of tax software for this purpose as of 2024.

Bear in mind

The process of filling out a tax declaration is often tricky. For some of our clients, it even becomes a real nightmare when real estate, cryptocurrencies, or securities must also be taken into account. Sorting all this out can take a tremendous amount of time to fully understand. Moreover, there is a high risk that something might be filled out incorrectly or forgotten. As a rule of thumb, this usually results in a higher tax burden at the end of the day. That is why having a reliable tax advisor at your side might come in handy.

Receiving the final tax assessment from your tax authority

Once a tax declaration is submitted, the cantonal tax authority reviews the declaration and issues a final tax assessment (Steuerbescheid). The final assessment contains details about the information the tax authority has taken into account (e.g., deductions such as health insurance, illness related costs, pension contributions, work-related or home-office expenses). This usually takes between 2 to 4 months, or up to 6 months depending on the canton. The tax assessment is mostly sent by mail, though in some cases it may be delivered electronically via the online tax portal.

Bear in mind

If you find errors in your final tax assessment—such as unaccounted tax deductions or adjustments to taxable income due to foreign taxes—you can appeal within 30 days by submitting a written letter and supporting documents to the cantonal tax authority. The authority will review your appeal and may either adjust or uphold the assessment.

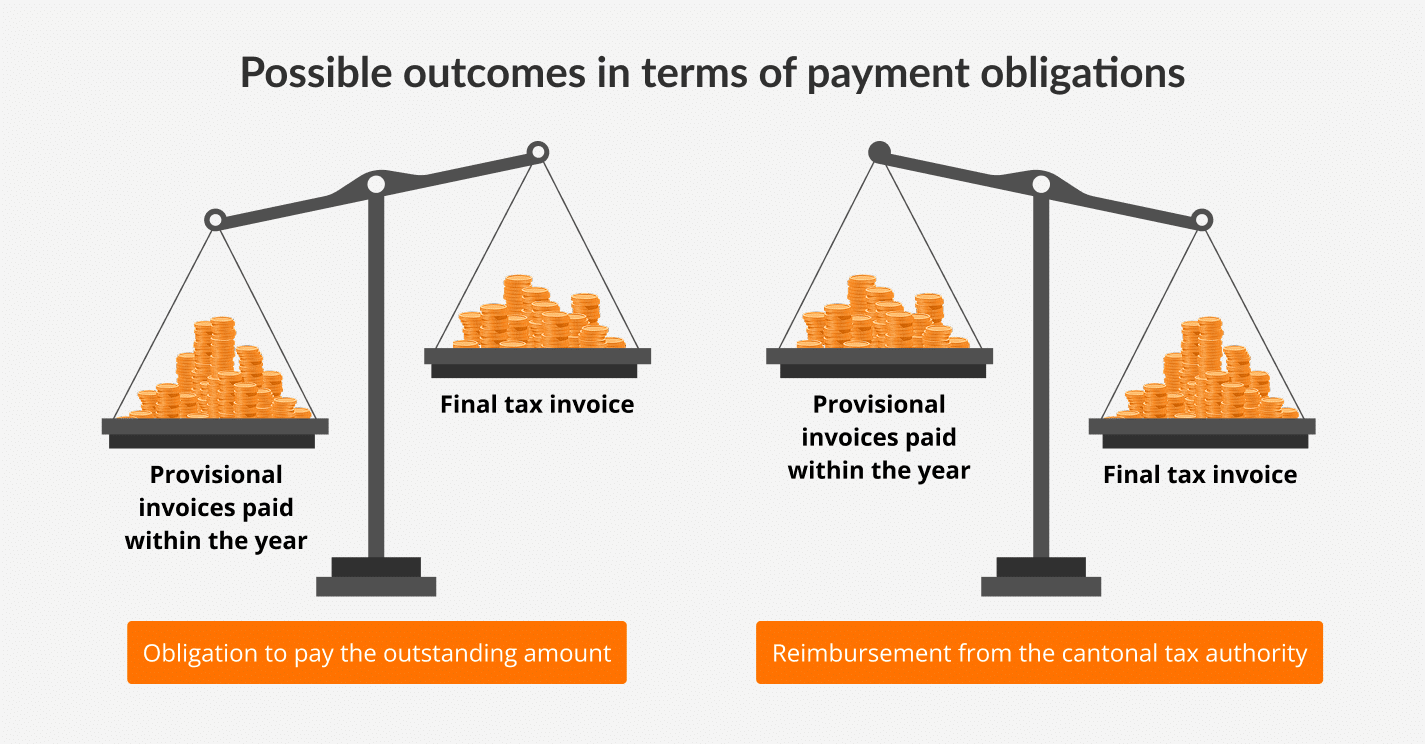

There are two potential outcomes in terms of payment obligations for both Swiss citizens/C permit holders and expats subject to withholding tax:

- The taxpayer has underpaid during the year and must pay the outstanding amount;

- The taxpayer has overpaid and will receive a reimbursement from the cantonal tax authority.

Expert tip

Did you know that overpaying taxes in Switzerland is often advantageous and might benefit you more than keeping your money in a bank account?

If you, as a private individual, pay more taxes in advance than you ultimately owe according to the final tax assessment, this is considered an overpayment. Usually, upon request, you will receive the excess amount back — plus interest on the overpaid amount!

These interest rates are often attractive and higher than the rates offered by banks on deposits — typically ranging from 0.5% to 2.5% per year, depending on the canton and the year. For example, the canton of Zurich offers an interest rate of 1.5% on overpaid taxes in 2024.

Occasionally, the tax authority may issue unusual communications during or after the assessment process. These could include requests for additional documents, such as bank statements or proof of deductions, to verify the submitted declaration.

Bear in mind

The reimbursement, in the case of overpayment, may take up to a year or even longer, based on past experience.

Still have questions about preparing your tax declaration? Our professional team is ready to assist you at the drop of a hat.

Leave Comment